Tax incentives for audiovisual productions, performing arts and live shows

Law 27/2014 on Corporate Income Tax establishes certain tax benefits in the form of a deduction from the gross tax liability to taxpayers who participate in certain activities of cultural interest, among which the following stand out:

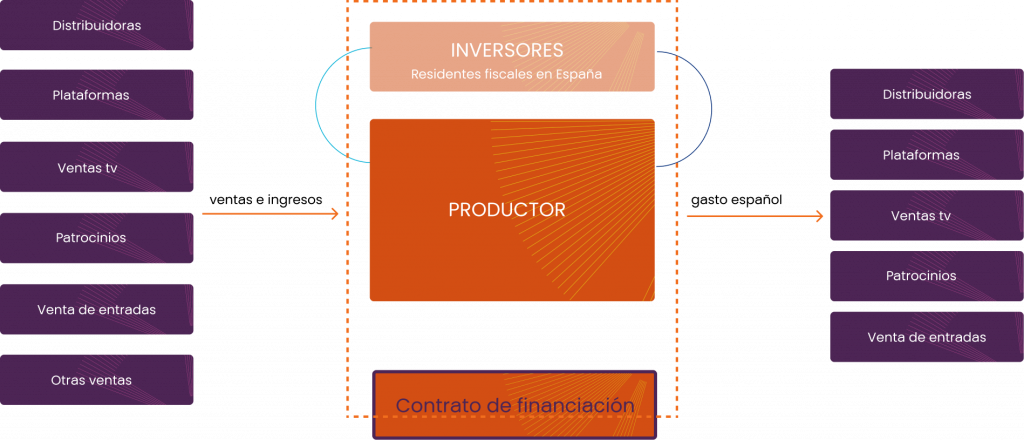

Most producers do not obtain sufficient quota to apply such tax incentives so it is allowed (Law / DGT Consultations) that other taxpayers apply such tax credits incentivizing private investment in the Spanish cultural sector.

Economic Interest Groupings have legal personality and mercantile nature and are governed by the provisions of Law 12/1991, of April 29, 1991, and, supplementarily, by the rules of the general partnership. The purpose of the EIG is to facilitate the development or improve the results of the activity of its members, with no profit motive for itself.

AIEs

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec tristique mollis dolor non hendrerit. Nulla eu ultrices neque, ac scelerisque urna. Pellentesque egestas efficitur est sit amet viverra.

- Suspendisse at felis rutrum tortor volutpat blandit eu pulvinar odio.

- Fusce tincidunt turpis nisi, vitae elementum sapien consequat at.

- Pellentesque arcu risus, blandit vel condimentum ut, semper non nisl

. Cras elit purus, pharetra et mattis ultricies, tristique vel massa. Curabitur sed augue non turpis tristique convallis sed a erat. Pellentesque imperdiet posuere velit non iaculis. Fusce vulputate ligula nunc, vel sollicitudin odio ullamcorper in. Ut iaculis finibus tincidunt.

Legal framework

With effect from January 2021, the General State Budget Law for 2021 introduced an additional mechanism for sharing the incentives for audiovisual and performing arts productions. Thus, the Corporate Income Tax Law (LIS) expressly regulates the figure of the financing contract, which allows the transfer of the deduction generated by the producer to those who play the role of financiers.

Taxpayers participating in the financing of Spanish productions of feature films and short films and audiovisual series of fiction, animation, documentary or production and exhibition of live shows of performing arts and music made by another taxpayer, may obtain tax incentives when they contribute amounts in concept of financing to cover all or part of the production costs.

Tax advantages for CA

Valencian Community

The deductions in the IRPF quota are increased, which is established at 25% for donations related to the Valencian cultural heritage, for donations destined to the promotion of the Valencian language and for donations or loans of use or gratuitous loan destined to other purposes of cultural, scientific or non-professional sports interest, being necessary in these last ones that the projects or activities have been declared or have the consideration of social interest to be able to benefit from the mentioned fiscal incentives.

And the reductions of the taxable base of the inheritance and gift tax regulated in number 2, paragraph two of article 10, and in paragraph 6 of article 10 bis of Law 13/1997 (LA LAW 1399/1998) will be applied.

Castilla La Mancha

Deductions of 15 percent of the regional gross income tax liability for donations of cultural assets and contributions in favor of the conservation, repair and restoration of assets belonging to the cultural heritage of Castilla-La Mancha, and for cultural purposes, included in the cultural patronage plan of Castilla-La Mancha.

Reductions in the ISD taxable base for the transfer of assets included in the Cultural Heritage Catalog of Castilla-La Mancha. The reduction will be, depending on the period of transfer, of the following percentage of the value of the transferred assets: a) 100 percent, for permanent transfers. b) 95 percent, for transfers of more than 20 years. c) 75 percent, for transfers of more than 10 years d) 50 percent, for transfers of more than 5 years.

La Rioja

Deductions with a joint annual limit of 500 euros per taxpayer:

Deduction of 15% of the amounts of money or material means donated to promote activities of general interest recognized within the framework of the Regional Patronage Strategy.

Deduction of 15% of the amounts of money or material means donated for research, conservation, restoration, rehabilitation, consolidation, dissemination, exhibition and acquisition of assets located in La Rioja, owned by the Administration of La Rioja and/or which have been expressly and individually declared assets of cultural interest and registered as such in the Inventory of Historical Heritage of La Rioja.

Deductions with an individual annual limit of 500 euros per taxpayer:

Deduction of 20% of the amounts donated for the development of certain cultural and artistic activities by cultural companies with tax domicile in La Rioja and whose equity is less than 300,000 euros.

Deduction of 20% of the valuation of cultural assets donated, or over which a real right of usufruct or temporary deposit is constituted without consideration, in favor of the cultural institutions of La Rioja.

This deduction may be applied by the authors of the assets or their heirs. Wealth Tax Incentives: A deduction of 25% of the value of the assets or rights that are destined (during the year after the date of accrual of the tax) to constitute a foundation or to increase the endowment of an existing foundation may be applied.

Álava

Deductions with a joint annual limit of 500 euros per taxpayer:

Deduction of 15% of the amounts of money or material means donated to promote activities of general interest recognized within the framework of the Regional Patronage Strategy.

Deduction of 15% of the amounts of money or material means donated for research, conservation, restoration, rehabilitation, consolidation, dissemination, exhibition and acquisition of assets located in La Rioja, owned by the Administration of La Rioja and/or which have been expressly and individually declared assets of cultural interest and registered as such in the Inventory of Historical Heritage of La Rioja.

Deductions with an individual annual limit of 500 euros per taxpayer:

Deduction of 20% of the amounts donated for the development of certain cultural and artistic activities by cultural companies with tax domicile in La Rioja and whose equity is less than 300,000 euros.

Deduction of 20% of the valuation of cultural assets donated, or over which a real right of usufruct or temporary deposit is constituted without consideration, in favor of the cultural institutions of La Rioja.

This deduction may be applied by the authors of the assets or their heirs. Wealth Tax Incentives: A deduction of 25% of the value of the assets or rights that are destined (during the year after the date of accrual of the tax) to constitute a foundation or to increase the endowment of an existing foundation may be applied.

Guipuzkoa

Deductions with a joint annual limit of 500 euros per taxpayer:

Deduction of 15% of the amounts of money or material means donated to promote activities of general interest recognized within the framework of the Regional Patronage Strategy.

Deduction of 15% of the amounts of money or material means donated for research, conservation, restoration, rehabilitation, consolidation, dissemination, exhibition and acquisition of assets located in La Rioja, owned by the Administration of La Rioja and/or which have been expressly and individually declared assets of cultural interest and registered as such in the Inventory of Historical Heritage of La Rioja.

Deductions with an individual annual limit of 500 euros per taxpayer:

Deduction of 20% of the amounts donated for the development of certain cultural and artistic activities by cultural companies with tax domicile in La Rioja and whose equity is less than 300,000 euros.

Deduction of 20% of the valuation of cultural assets donated, or over which a real right of usufruct or temporary deposit is constituted without consideration, in favor of the cultural institutions of La Rioja.

This deduction may be applied by the authors of the assets or their heirs. Wealth Tax Incentives: A deduction of 25% of the value of the assets or rights that are destined (during the year after the date of accrual of the tax) to constitute a foundation or to increase the endowment of an existing foundation may be applied.

Bizkaia

Deductions with a joint annual limit of 500 euros per taxpayer:

Deduction of 15% of the amounts of money or material means donated to promote activities of general interest recognized within the framework of the Regional Patronage Strategy.

Deduction of 15% of the amounts of money or material means donated for research, conservation, restoration, rehabilitation, consolidation, dissemination, exhibition and acquisition of assets located in La Rioja, owned by the Administration of La Rioja and/or which have been expressly and individually declared assets of cultural interest and registered as such in the Inventory of Historical Heritage of La Rioja.

Deductions with an individual annual limit of 500 euros per taxpayer:

Deduction of 20% of the amounts donated for the development of certain cultural and artistic activities by cultural companies with tax domicile in La Rioja and whose equity is less than 300,000 euros.

Deduction of 20% of the valuation of cultural assets donated, or over which a real right of usufruct or temporary deposit is constituted without consideration, in favor of the cultural institutions of La Rioja.

This deduction may be applied by the authors of the assets or their heirs. Wealth Tax Incentives: A deduction of 25% of the value of the assets or rights that are destined (during the year after the date of accrual of the tax) to constitute a foundation or to increase the endowment of an existing foundation may be applied.

PKF Attest as advisor on entertainment tax incentives

PKF Attest Entertainment positions itself as a quality and reputable source of legal and tax advice by providing companies and individuals in the entertainment industry (production companies, film studios, agencies, theaters, platforms, musicians and artists, sporting events and organizations, etc.) with expert guidance based on decades of experience and a proactive approach to sustainable business success.

Advice to the producer

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Drafting of documents

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Legal, tax and accounting assistance to the financing partner

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Drafting of agreements between partners

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Expense validation

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Advice to the producer

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Tax analysis of the structure

- Analysis of the requirements necessary for the producer to generate the tax incentives to be passed on to the financiers (Articles 36 and 39 of the Corporate Income Tax Law).

- Analysis of the requirements based on the doctrine developed by the Directorate General of Taxes in relation to such structures.

- To provide the necessary support so that the structure resulting from the proposed operation allows the application of the deduction relating to the production and exhibition of live shows in productions contained in articles 36 and 39 of the LIS.

How do contracts work?

The benefit for the financier is determined by the difference between the financing provided and the amount of the tax credits that will be imputed (deductions in quota) in its self-assessment of the IRPF (RAE) or IS, with a maximum of 120%.

The investor will account as financial income the difference between the disbursement made and the deduction to be applied in its self-assessment of the IS/IRPF. This income is subject to IRPF (savings tax base) or IS.

Investor benefits

The benefit for the investor is determined by the difference between the investment made in the acquisition of EIG shares and the amount of the tax credits that will be imputed (BINS and deductions in quota) in its self-assessment of personal income tax (RAE) or IS.

The investor will account for its participation and contribution to the Economic Interest Grouping as a financial instrument (ICAC Report of March 25, 2009) and the company/entrepreneur will obtain at least:

20% return on the investment made (guaranteed "by law" through the subscription of the financing contract). If this investment is made through an EIG, the return could be higher depending on the structuring of the production.

Who will pay me back the money I invested

Deductions with a joint annual limit of 500 euros per taxpayer:

How much do I have to invest?

Deductions with a joint annual limit of 500 euros per taxpayer:

Benefits for the producer

The producer, with the entry of investors to whom he imputes the deductions he generates and cannot apply, monetizes a large part of these deductions, thus obtaining financing for new productions.

But, if an investor enters, will I have a partner with the right to my work? NO, the investors will only enjoy the imputation of the deductions without having any right on the realized work.

If an investor comes in, does he have rights to my work?

Deductions with a joint annual limit of 500 euros per taxpayer:

Do tax incentives for investments in stage productions include live performances?

Deductions with a joint annual limit of 500 euros per taxpayer: