The current regulations make it possible to generate a tax deduction through the financing of third-party cultural projects, generating a very significant tax return and with sufficient legal certainty. And all this without the need to belong to the audiovisual or live performance sector, nor to participate in its development or result.

What does this opportunity consist of?

Both the Ministry of Finance and the Tax Agency and the Regional Treasuries have been making a firm commitment to promote the world of culture. The formula used has been the approval of significant tax benefits in the form of corporate income tax deductions for producers of audiovisual works (films, series, documentaries, etc.) and for promoters of live shows (concerts, plays, etc.). However, these measures are effective when the producer or promoter obtains profits derived from their activities, as this is the only way to take advantage of the aforementioned deductions.

Being aware of this, in order to support producers, promoters or publishers who do not make a profit, the Personal Income Tax and Corporate Income Tax regulations allow these tax incentives to be enjoyed by businessmen or professionals who have nothing to do with the culture sector, so that the latter, instead of the former, can access the tax benefits, thus attracting investment to the sector.

How is it articulated?

Traditionally, the financing of this type of projects has been carried out through two methods: (i) participation in economic interest groupings (EIGs), and (ii) financing contracts regulated by tax legislation. Investment through EIGs had additional tax advantages, since it allowed the application of a higher amount of deductions; although it is a figure that, on occasions, has presented certain controversy in inspection proceedings and, therefore, offers less legal certainty.

On the other hand, the use of financing contracts offers, in our opinion, more legal certainty. Through the use of this figure, companies and individuals who obtain income from professional or business activities deliver the amount they wish to the producer, promoter or publisher on a non-refundable basis, and the amount delivered is recovered by applying a deduction in their corporate income tax or personal income tax return, as the case may be.

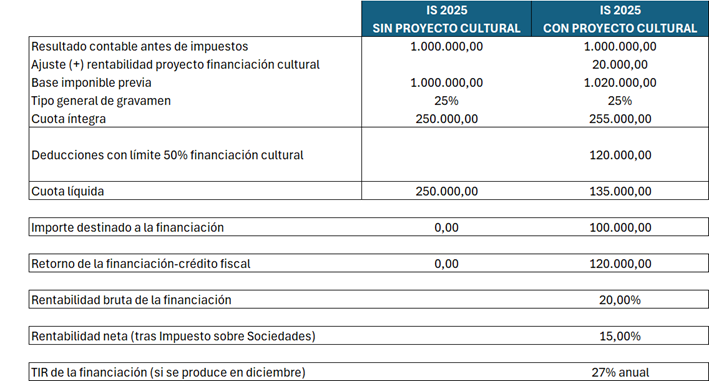

In this way, the investor, whether it is a company or an individual earning business or professional income, can obtain a gross return of 20%. If €100,000 is invested in December of year X, €120,000 gross and €115,000 net can be obtained in six/seven months (with an APR close to 30%).

By way of illustration, we would like to show a case in which a company that has a pre-tax result of €1 million decides to invest in an audiovisual project an amount that allows it to optimize its taxation for the year (it should be taken into account that the deduction may reach, in certain circumstances, up to 50% of the total tax liability):

In the case of individuals, the return is also attractive, but since the tax rate is progressive, the net tax savings will depend on the average tax rate applicable to each taxpayer.

This is therefore a very attractive investment opportunity, since it allows obtaining, with sufficient legal certainty, a return of around 15% in a short period of time, provided that all the requirements of the regulations are met.

What conditions must be met or taken into account?

- That the investor is a legal entity, professional or entrepreneur, natural person who obtains income from economic activity.

- That the investor obtains profits in the fiscal year corresponding to the year in which the investment is made.

- That the investor does not have other tax credits that do not allow him to take full advantage of this deduction.

What is the cost to the investor?

None. As of today, all costs associated with the transaction (structuring, legal advisors, audit reports, etc.) are borne by the producer/promoter, so that the investor is assured of the net return indicated above.

What do we offer at PKF Attest?

At PKF Attest we have been advising on this type of investment for years, ensuring compliance with all formal and fiscal requirements to maximize profit and minimize risk. In addition, we have access to a wide portfolio of solvent cultural projects seeking financing.

If this opportunity interests you, I will be happy to explain it in detail and analyze if it fits your tax situation.